Apple supplier Taiwan Semiconductor Manufacturing Company (TSMC) Q2 revenue came out better than forecast.

Revenue grew 28.9% compared to the same quarter last year, reaching US$10.38 billion. Gross profit increased 53%; net operate income increased 42.2%. Earnings per share reached a record high of NT$4.66.

TSMC Q2 performance was free from the impact of coronavirus because:

-

Demand for 5G-related technologies is having a jump start and demand for high-performance computing devices during quarantine was strong, too. Revenue of HPC devices grew 12% from the previous quarter, while revenue of smartphones decreased 4%, IOT decreased 5%, vehicle electronics declined 13% and consumption electronics declined 9%.

-

Demand for advanced-processed chips outperforms demand for other chips. Revenue of 7nm chips accounts for 36% of overall revenue; 16nm chips for 18%.

To investors’ surprise, TSMC keeps an ongoing optimistic outlook for 2020. The US Sanctions on Huawei did not inflict apparent loss on the semiconductor giant. It raises its annual revenue growth to 20% from between 15 to 20% and its annual capital expenditure to US$16 to 17 billion by 10 billion. Overall, TSMC’s prospect for 2H 2020 is even brighter.

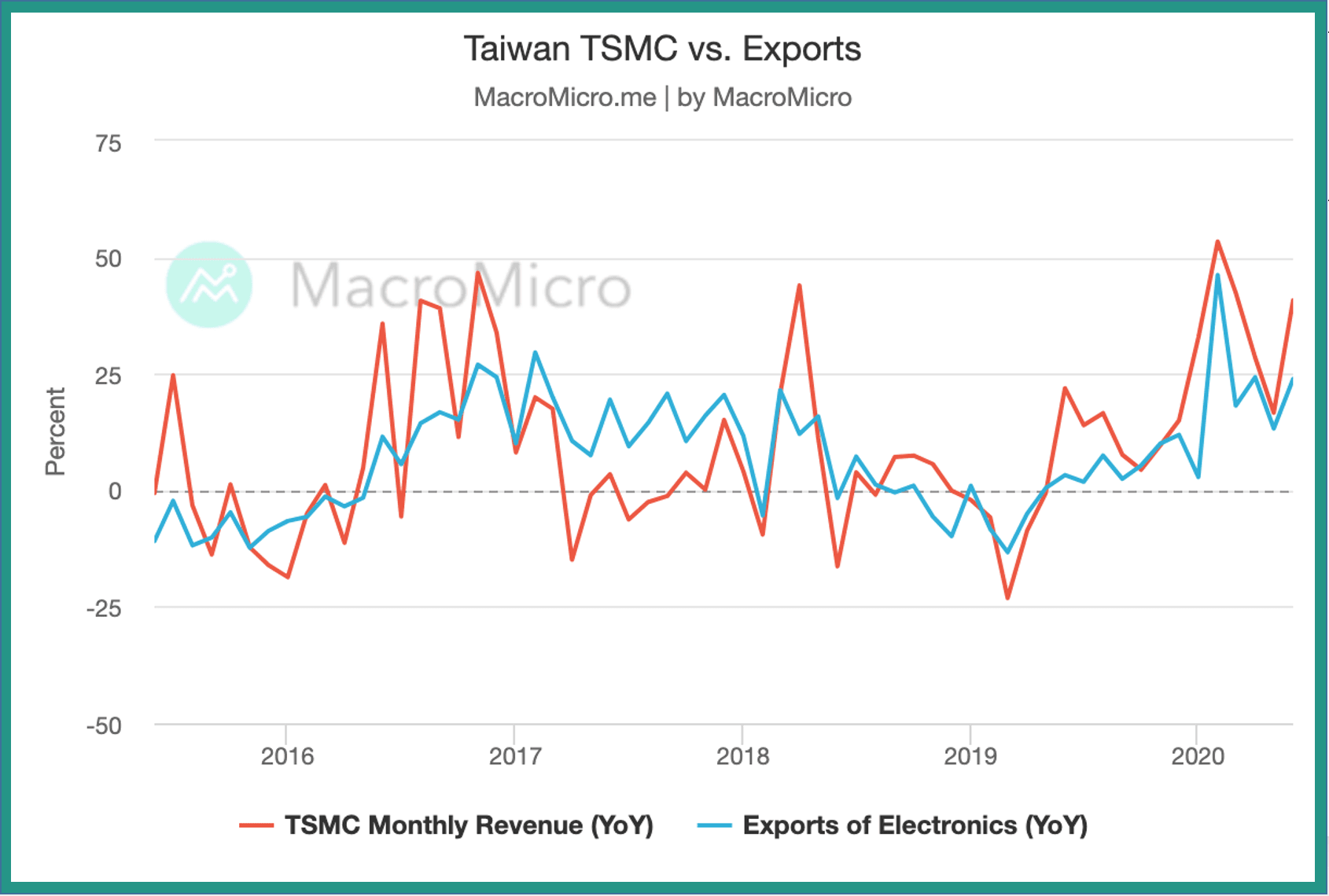

Based on its previous forecasts of revenue, it is believed that TSMC in 2020 will generate an 24.6% increase in revenue, or US$43.1 billion, compared to last year.

The revenue hole created by sanctions on Huawei will be filled by strong demand for Apple 5G phones.

The third and fourth quarter are also the high season for electronics manufactures. TSMC’s excellent prospect for the year will support Taiwan’s stock market, where TSMC has the biggest weight in Taiwan Capitalization Weighted Stock Index (TAIEX).

Taiwan’s electronics industry leads the world. Data has shown that Taiwan’s exports of electronics maintained robust growth in June. Backlog of orders are decreasing, so in the second half of 2020, a bigger inventory replenishment is very well anticipated by the industry from its customers. Plus TSMC’s optimistic estimates, we are eyeing on another long-term upturn in TAIEX.