After reaching record highs in early March, global stock markets, including the three major US stock indices, took a breather last week. Is the recent pause linked to overheated market sentiment? In this article, we discuss five useful sentiment indicators and where they stand right now.

Beyond that, many may be wondering whether the exuberance points to imminent corrections or if such optimism reflects underlying fundamentals and valuations? We also answer this question at the end of the article, with findings from backtesting analysis on stock fundamentals that can help investors analyze market sentiment more effectively.

For more market sentiment indicators, visit our new Market Sentiment chart collection in the Trader’s Insight section:

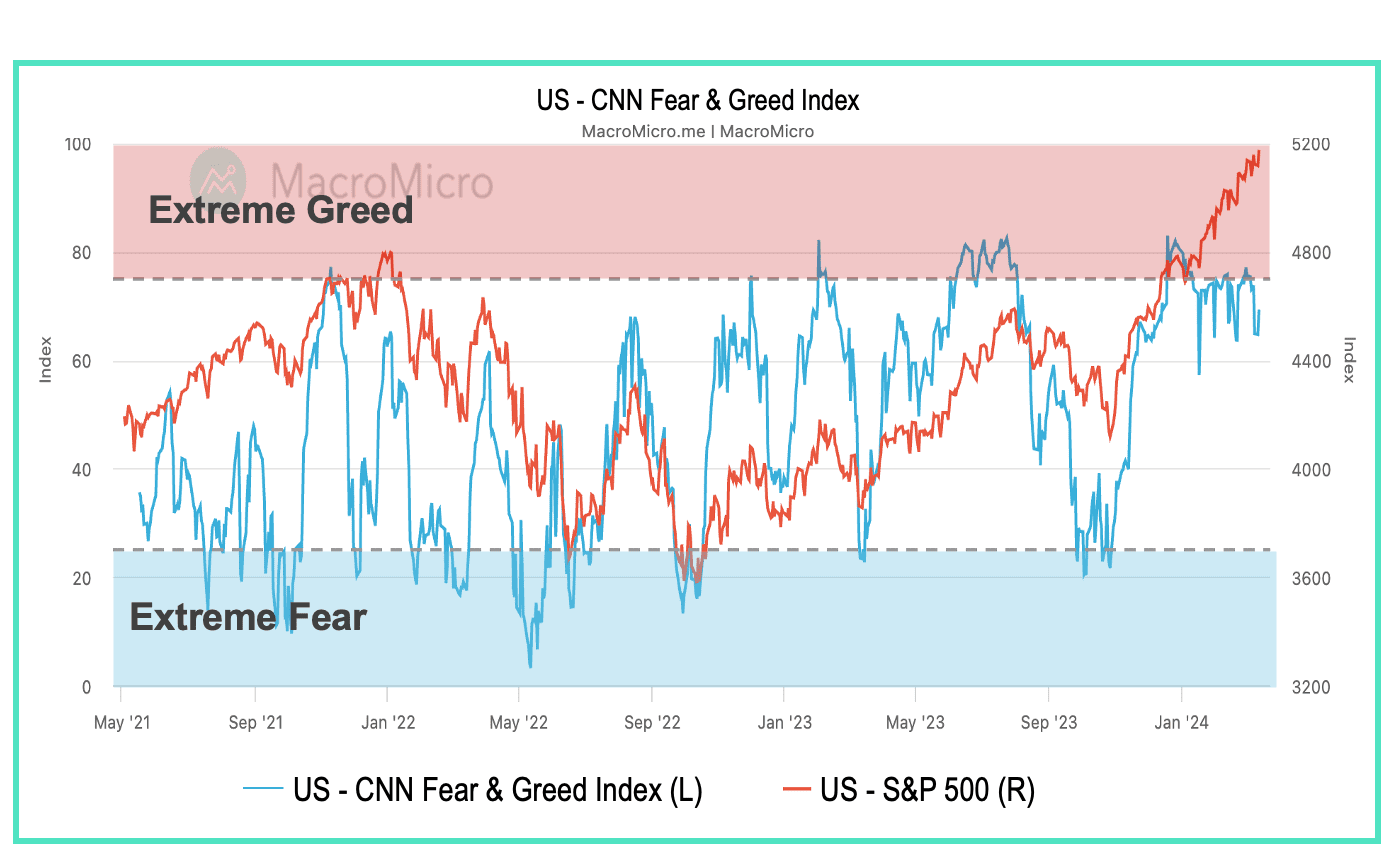

▌Indicator 1: CNN Fear & Greed Index

Developed by CNN Business, the CNN Fear & Greed Index is a composite index of variables related to market sentiment for the US stock market. Variables include market momentum, stock price strength, stock price breadth, put/call ratio, market volatility, safe haven demand, and junk bond demand. Equally weighted in the index, each variable is measured against its mean, i.e. how much the current value deviates from its average.

(Customize | View Chart)

(Customize | View Chart)

👉 Pointers: The CNN Fear & Greed Index is positively correlated with the US stock market. A score above 75 signals extreme greed, indicating stocks are rising fast and the market might be overheated, while a reading below 25 indicates extreme fear, suggesting overly bearish sentiment and market bottoms might be close. Since the end of January, the index has been hovering between the greed and extreme greed territory, suggesting US stock valuations have indeed become a bit too hot, at least for the short-term.

The Total Put/Call Ratio by the Chicago Board Options Exchange (CBOE) divides the trading volume of put options by that of call options, reflecting broader market sentiment in the US stock market.

【 MM Podcast 】 Free Gift for Graduates & Students!