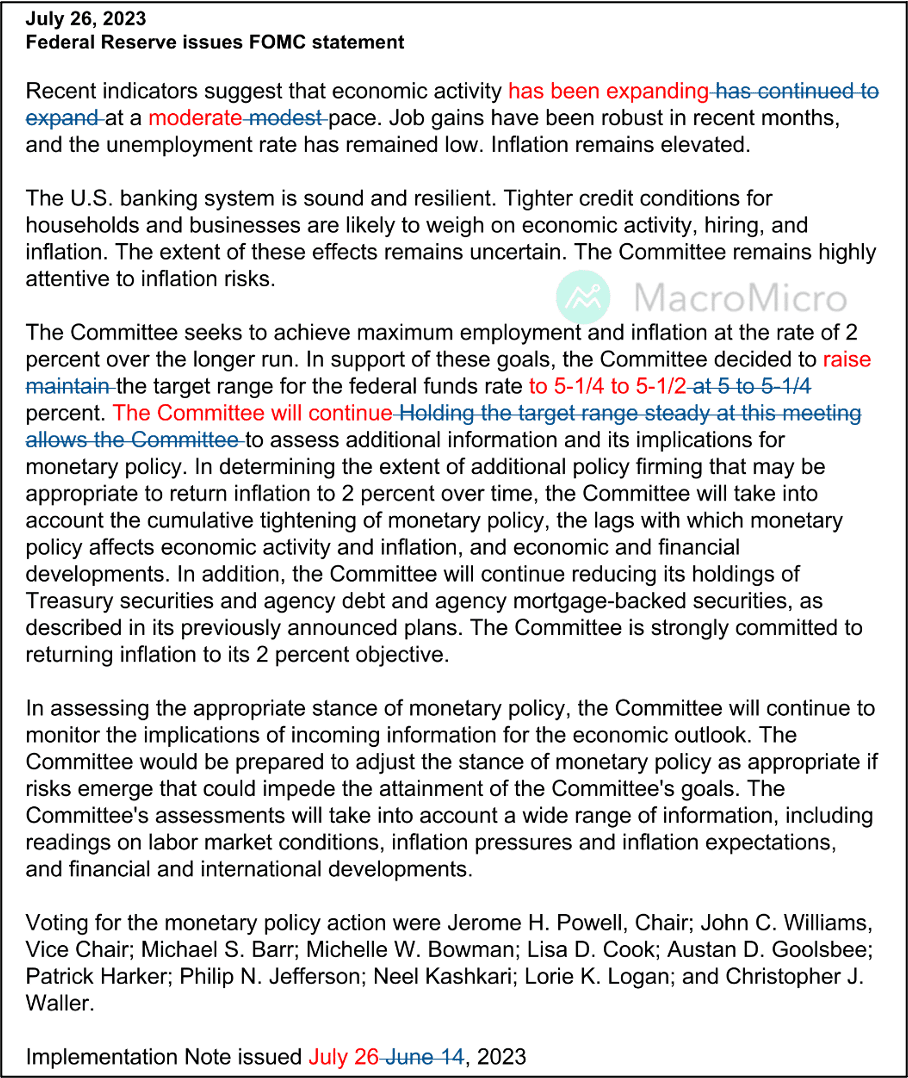

The Federal Reserve has raised interest rates by 0.25 percentage point to the range of 5.25% to 5.50%. Although Chairman Powell did not explicitly state that July would be the final rate hike, he provided more clues about potential rate cuts next year, as discussed in the following analysis:

1. Limited Changes in July Statement - No Clear Indication that July is the Final Rate Hike

During the meeting, all FOMC voting members agreed to raise interest rates by 0.25 percentage point, setting the range at 5.25% to 5.50%. The official statement closely aligned with the June statement. Powell stated during the press conference that no decisions have been made regarding future meetings, including the pace of rate hikes. Ahead of the September meeting, the committee will receive two employment reports, two CPI reports, and this week's ECI report. Powell has stated that the decision regarding a rate hike at the September meeting has not been finalized yet, and he has not ruled out the possibility of consecutive rate hikes. The FOMC will carefully assess the economic situation on a meeting-by-meeting basis. Powell also emphasized that adopting a slower decision cycle is considered reasonable.

2. No Need to Wait for Inflation to Reach 2% before Pausing or Lowering Rates

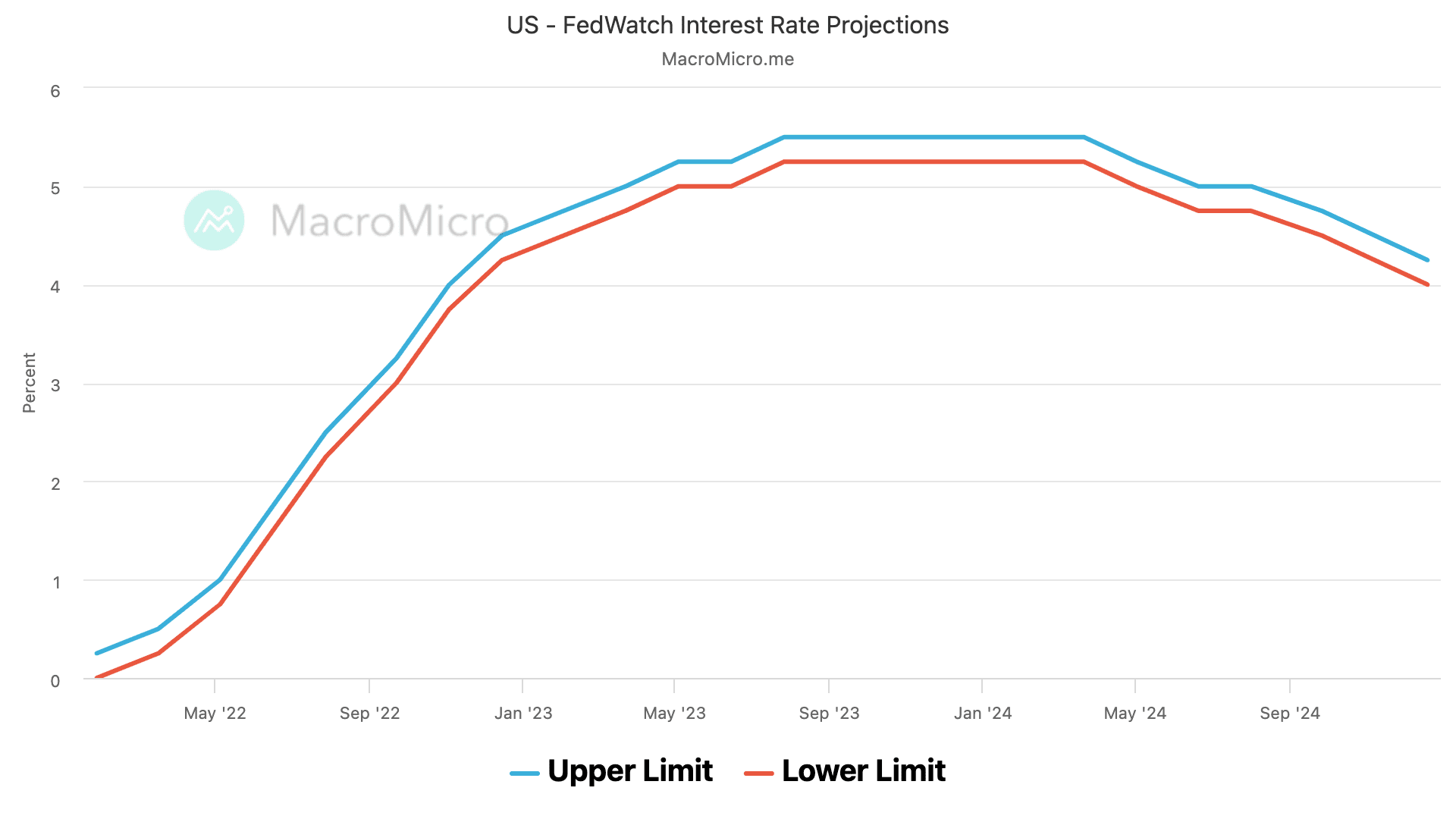

Although inflation is not expected to drop to 2% quickly and may not achieve that target until 2025, Powell denies the necessity of maintaining high rates for two years. As inflation continues to decelerate and approaches the policy target, the Federal Reserve can consider rate cuts. Based on the interest rate dot plot from the June meeting, many committee members have indicated the possibility of rate cuts next year. However, this is not expected to happen this year.

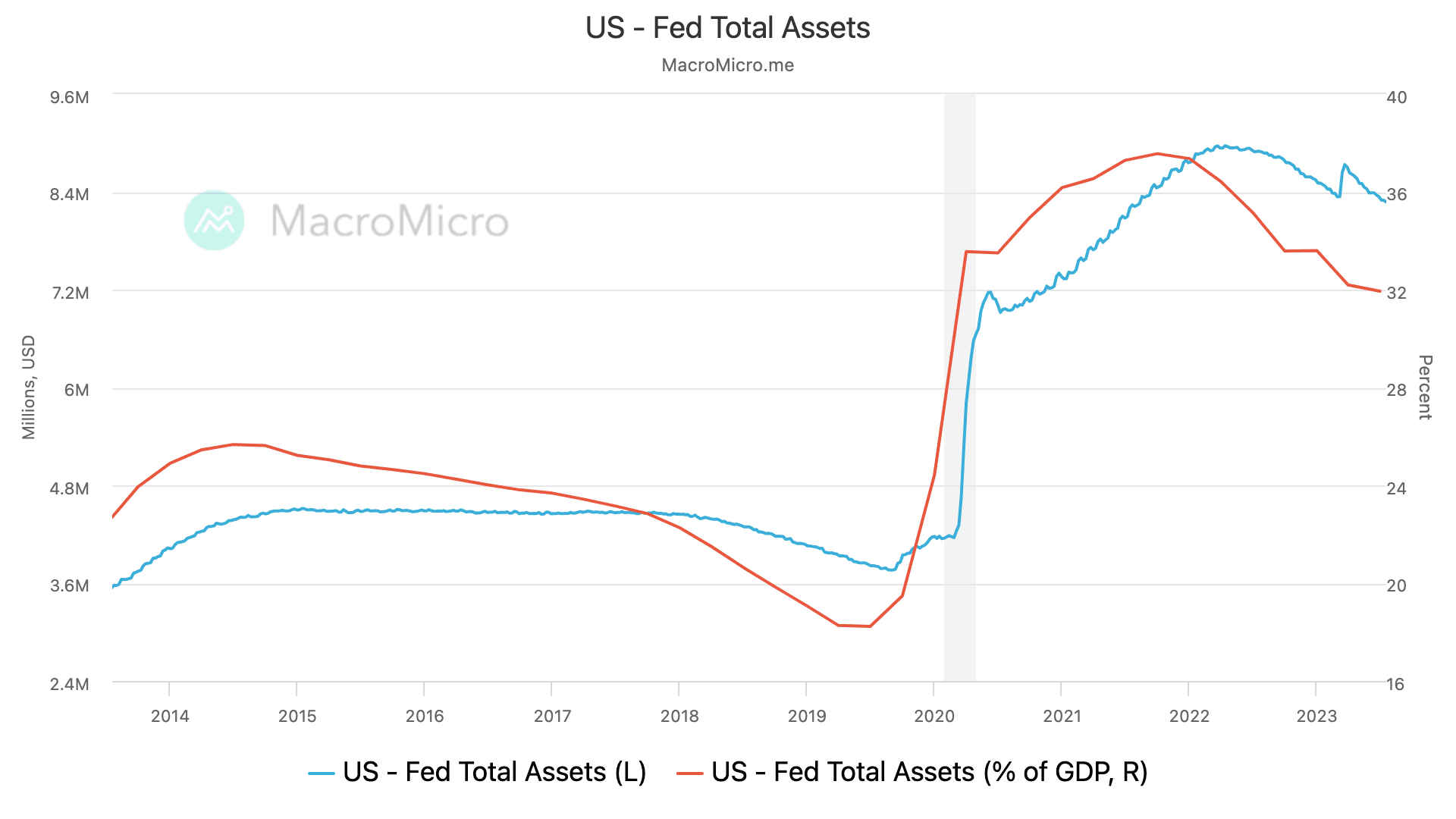

3. Fed Will Continue QT - Simultaneous QT and Rate Cuts are Possible

In the July meeting, the Federal Reserve maintained the pace of balance sheet reduction at $95 billion per month ($60 billion in U.S. Treasuries and $35 billion in MBS). The Fed's holdings of U.S. Treasuries and MBS have decreased from peak levels of $5.77 trillion and $2.74 trillion to $5.08 trillion and $2.54 trillion, respectively, resulting in the total assets on the balance sheet decreasing to $8.27 trillion, the lowest level since the March banking crisis.

When asked about the possibility of the Fed continuing balance sheet reduction while simultaneously implementing rate cuts, Powell stated that such a scenario is feasible, saying, "So that could happen." Both tools are part of the monetary policy normalization process. If the economic environment remains favorable and it is time to move interest rates from restrictive levels to neutral levels, the FOMC can implement rate cuts while continuing balance sheet reduction.